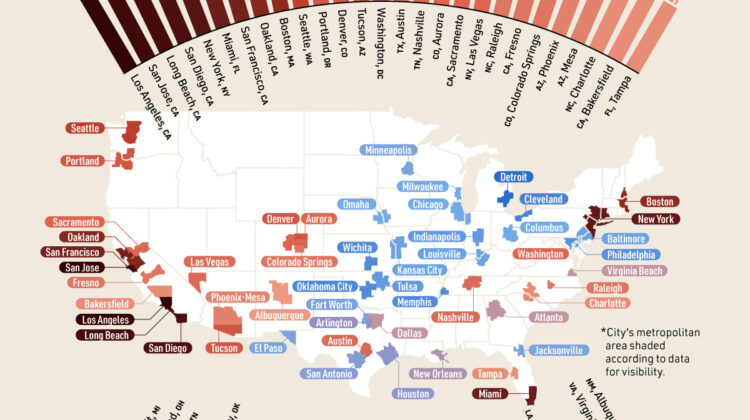

We don’t have a real estate bubble, we have a home price-to-wage growth bubble. The chart highlighting the home price-to-income ratios in major U.S. cities reveals just how drastically home prices have outpaced wage growth.

- Historically, a 3:1 ratio was considered affordable, meaning a home should cost about three times the median household income.

- However, many cities have seen that ratio swell to 5:1, 6:1, and in extreme cases, like Los Angeles and San Francisco, over 10:1.

This disconnect has created a significant affordability gap, making it harder for average earners to buy homes. For real estate investors, this presents both risks and opportunities.

- As home prices continue to detach from incomes, the pool of traditional homebuyers shrinks, potentially driving more demand in the rental market.

- On the flip side, those buying at today’s inflated prices in overheated markets are taking on considerable risk.

Three Likely Outcomes for Housing Prices:

1. Lower Interest Rates to Boost Affordability: A return to the ultra-low interest rates of recent years could temporarily make homes more affordable by lowering monthly mortgage payments. However, this would likely fuel further home price appreciation, continuing the cycle of unaffordable housing. With the Fed focused on fighting inflation, significant rate cuts are unlikely without risking an inflation spike.

2. Wages Need to Rise Sharply: Incomes would need to double or even triple in some cities to match current home prices. This is highly unlikely in today’s economy. Moreover, such sharp wage growth would bring its own challenges, fueling inflation and driving up the cost of living, which would make affordability even more elusive.

3. Home Prices Will Fall: The most likely outcome is a significant correction in home values as affordability constraints tighten and market forces push prices to align with real wages. This correction or crash could bring home price-to-income ratios back to more sustainable levels, such as 3:1 or 4:1.

Given the economic outlook, where the Fed’s ability to lower interest rates is limited by inflation risks, the highest probability scenario is a correction in home values. For investors, this could mean preparing for opportunities to acquire properties at a discount once the market adjusts. However, until that happens, it’s essential to approach overheated markets with caution, as high price-to-income ratios suggest that these areas are unsustainable in the long term.

In short, while the current market presents challenges, investors who navigate these turbulent times wisely can position themselves for substantial gains when the market rebalances. The key is being ready for falling property values that align with real wages.

That’s why we’re excited to announce Spatial Hub, an essential tool designed to help you find the best deals in today’s market. Spatial Hub curates all the key data sources, property listings, comps, and local market trends in one place, empowering you to make smarter, well-informed investment decisions. You define your buy box, and it will find properties that meet your criteria, helping you navigate the volatility and capitalize on the best opportunities.

Stay tuned—Spatial Hub is launching soon!

About STR Scout

STR Scout is a newsletter crafted to help you enrich your life and grow your wealth globally through strategic investments in Airbnb properties and short-term rentals. We provide tools, resources, and insights tailored for real estate investors, guiding you to make informed decisions. The twice-weekly newsletter delivers property scouting reports, market trends, STR classifieds, and investment news, helping you discover the best opportunities in the global short-term rental market. Join here.

About STR Homes for Sale

STR Homes for Sale is the top Facebook marketplace for buying and selling Airbnb properties and short-term rentals, boasting 98,700 members. Since 2017, it has connected real estate investors with sellers, offering a free platform to showcase both on and off-market STR properties. With hundreds of thousands of monthly views, this community is a vital resource for those looking to maximize exposure and secure the best deals in the short-term rental market. Join here.